Next article

Kate Spade Mystery Shopping: 60 Store Visits Across North America in Under Three Weeks

How to Run Focus Groups Across Multiple Countries

Running focus groups in your home market is straightforward enough. You know the recruitment channels, you understand the cultural dynamics, and you can pop into the viewing room to watch the research unfold.

Now try doing that in six countries simultaneously.

International focus groups are one of the most powerful tools for understanding consumers across markets — but they're also among the most complex qualitative methodologies to execute well. With 57% of researchers reporting growing demand for qualitative research (Qualtrics, 2024), knowing how to conduct multi-country studies effectively has become a core competency for global brands.

Get it right, and you'll watch real consumers in Berlin, Bangkok, and Buenos Aires react to your concepts in real time. Get it wrong, and you'll spend budget on research that can't be meaningfully compared across markets — or worse, actively misleads you about what's actually happening in each country.

This guide is everything we've learned from running 315+ multi-country studies across 55+ countries. The process, the pitfalls, and the moments where cultural nuance makes all the difference.

Focus groups are often chosen by default because they're familiar. But familiarity isn't the same as fit.

Focus groups work well when you need to:

Test concepts, packaging, or advertising and watch reactions unfold

Understand how people naturally talk about a category

Explore group dynamics and social influence on opinions

Generate ideas through participant interaction

Focus groups are the wrong choice when:

The topic is sensitive or personal (health, finance, parenting struggles)

You need to understand individual decision journeys in depth

Your participants are senior executives or hard-to-reach professionals

Social desirability bias might distort honest responses

If you're not sure, think about what kind of insight you actually need. Do you need to see how ideas evolve as people build on each other's reactions? Focus groups. Do you need to trace an individual's decision journey in detail? In-depth interviews. Do you need to observe actual behaviour? Ethnography.

Not sure which methodology fits your objectives? Our methodology selection guide walks through the decision framework step by step.

Vague objectives produce vague insights. And vague insights don't inform decisions.

Too vague: "Understand attitudes toward our brand across Asian markets."

Better: "Determine why our premium tequila isn't gaining traction with affluent consumers in China and South Korea, despite strong performance in Australia."

Best: "Identify which brand attributes, occasions, and messaging would make premium tequila feel aspirational and relevant in markets dominated by whisky and cognac — with specific direction for each market."

Start with the decision you need to make, then work backward to the research that would inform it. The clearer your objective, the sharper your discussion guide, and the more actionable your findings.

Don't default to "major markets." Choose countries based on strategic rationale:

🌍 Strategic priority: Where are you investing or planning to grow? Those markets matter most.

🔍 Performance differences: Where are you succeeding vs. struggling? Comparing a strong market with a weak one often reveals more than studying similar markets.

🗺️ Cultural diversity: Three Western European markets may yield less insight than one European, one Asian, and one Latin American market. Think about what diversity will actually teach you.

Most multi-country focus group studies include 3–6 markets. Fewer than three may not justify the complexity. More than six becomes logistically overwhelming and analytically difficult.

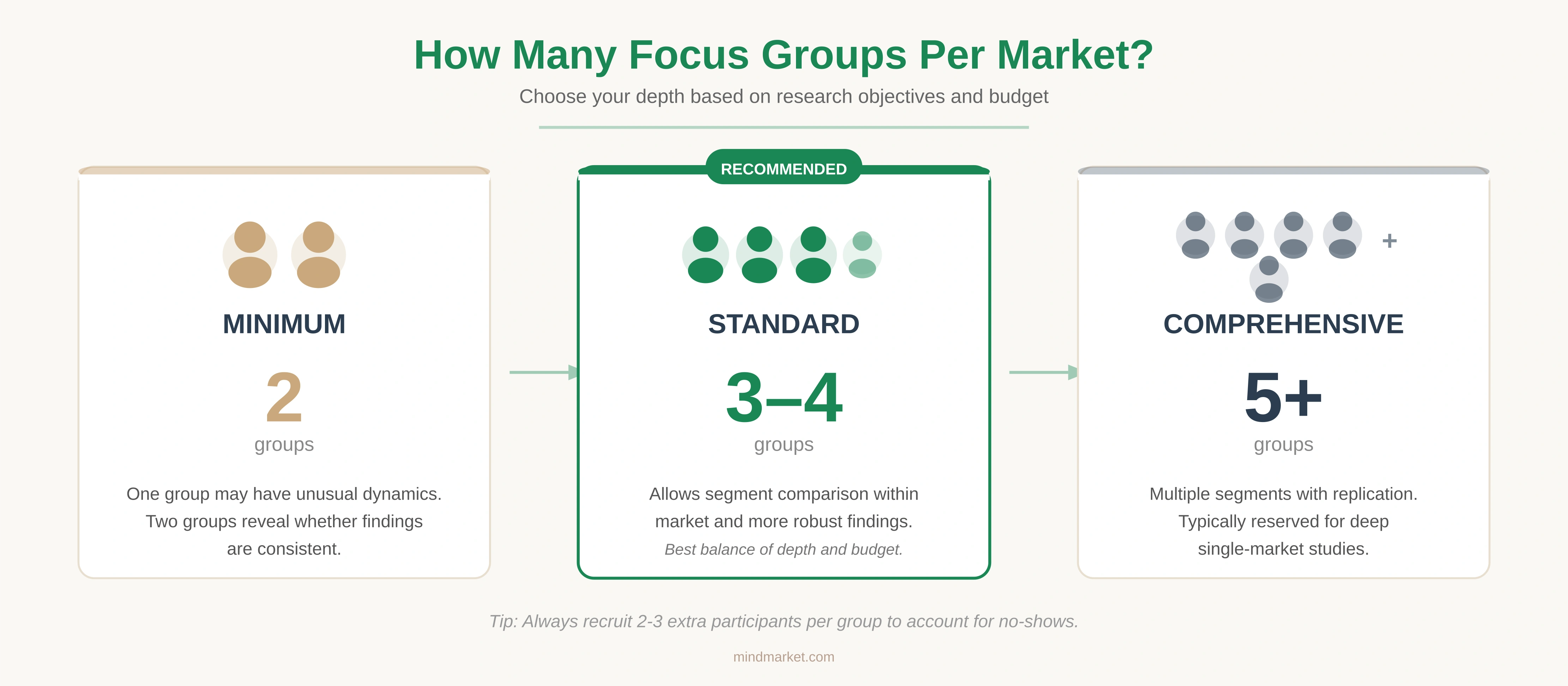

How many groups per market? What audience segments?

Minimum: 2 groups. One group may have unusual dynamics. Two groups reveal whether findings are consistent.

Standard: 3–4 groups. Allows segment comparison within market and more robust findings.

Comprehensive: 5+ groups. Multiple segments with replication. Typically reserved for deep single-market studies.

Decide whether you need separate groups for different demographics (age, gender, income), behaviours (heavy vs. light users, brand buyers vs. competitors), or attitudes (early adopters vs. mainstream).

Key principle: Don't mix segments that might inhibit each other. Mixing heavy and light users often means heavy users dominate. Mixing ages may create deference dynamics in some cultures.

Here's a truth most agencies won't tell you: recruitment quality determines research quality. The best discussion guide in the world won't save a study with the wrong participants in the room.

Screen for behaviour, not just demographics. "Regularly spends above average on luxury drinks in high-end venues" is more useful than "interested in premium spirits."

Work with local partners. Established fieldwork agencies have access to panels, understand local recruitment channels, and know how to approach participants culturally.

Over-recruit. Always recruit more participants than you need:

| Target Group Size | Recruit |

|---|---|

| 6 participants | 8 |

| 8 participants | 10-11 |

| 10 participants | 12-13 |

No-show rates vary by market. Northern European participants almost always show up. Other regions need larger buffers.

Set appropriate incentives. What motivates participation in London may feel different in Tokyo or São Paulo. Consult local partners on appropriate levels — getting this wrong affects both recruitment success and participant quality.

Your discussion guide is the roadmap for every moderator in every market. It needs to be clear enough for consistency but flexible enough for cultural adaptation.

Introduction (10 mins): Moderator and participant introductions, ground rules, warm-up

Opening exploration (15 mins): General category discussion, current behaviours and attitudes

Core content (45–60 mins): Main research topics, stimulus exposure and reactions, probing

Wrap-up (10 mins): Summary reactions, final thoughts, anything not covered

✅ Write conceptual questions, not literal ones. Ask about underlying attitudes and behaviours, not specific terminology that may not translate.

✅ Build in flexibility. The guide is a framework, not a script. Allow local moderators to adapt phrasing and probing to local conversation flow.

✅ Avoid idioms and cultural references. What makes sense in English often doesn't translate — literally or culturally.

✅ Specify intent, not just questions. Tell your local moderators what you're trying to learn with each section, so they can probe effectively even when the conversation goes somewhere unexpected.

❌ Don't over-script. Rigid minute-by-minute guides prevent moderators from following the conversation where it naturally leads.

When a British multinational beverage company wanted to boost luxury tequila sales across Asia Pacific, they faced a challenge that spreadsheets alone couldn't solve. With the APAC tequila market growing at 10.2% annually and premium spirits consumption surging across the region, the opportunity was clear. What wasn't clear was how to connect with affluent consumers who had little cultural connection to agave-based spirits.

The brief: Understand why premium tequila wasn't gaining traction in markets dominated by whisky and cognac — and identify what would make it feel aspirational and relevant.

The approach: We designed a multi-methodology programme across China, South Korea, Australia, Singapore, and Indonesia. Phase one focused on consumers: two focus groups per market with participants who regularly spend above average on luxury drinks in high-end venues.

What the focus groups revealed:

Each market told a different story. In Shanghai, participants suggested that tequila could gain credibility through co-hosting events with luxury fashion brands — aligning the spirit with existing aspirational lifestyles rather than trying to build category awareness from scratch.

In Seoul, consumers expressed genuine curiosity about tequila's artisanal production process. The insight: educational initiatives could help overcome unfamiliarity, but only if delivered through credible voices, not advertising.

Australian participants highlighted the growing cocktail culture as an entry point. The Margarita and Paloma weren't seen as "basic" — they were accessible gateways to premium tequila appreciation. The brand didn't need to fight cocktail culture; it needed to elevate it.

These weren't insights you'd find in a market report. They were human stories that revealed genuine opportunities — and they came from watching real consumers react in real time.

Read the full case study

We're regularly asked: should we use local moderators or send our own team with translators?

Our answer: local moderators, almost always.

Language fluency: Native-language moderation captures nuance that translation misses. The difference between what someone said and what they meant often lives in words that don't translate directly.

Cultural intuition: Local moderators read body language, hesitation, and social dynamics that outsiders miss. They know when "yes" means genuine agreement and when it means polite disagreement.

Natural rapport: Participants open up more quickly with someone who shares their cultural context. The warm-up moves faster, the conversation goes deeper.

The key is thorough briefing. Your local moderators need to understand:

The objectives: What are you trying to learn? What decisions will this inform?

The intent behind questions: Not just what to ask, but what you're hoping to discover

Client hot buttons: What are they particularly interested in? Any sensitivities?

Practical requirements: Recording, observation protocols, timing

Ideally, brief all moderators together on a video call before fieldwork. This ensures consistent understanding and allows moderators to learn from each other's questions.

Culture shapes how people participate in focus groups — and misreading these dynamics leads to misinterpreting findings. ✨

High-context cultures (Japan, China, Arab countries, much of Latin America): Meaning is often implicit. Direct criticism may be avoided. Silence doesn't mean disagreement. Building rapport before business discussion is essential.

Low-context cultures (Germany, Netherlands, Scandinavia, US): Communication tends to be explicit and direct. Participants may be comfortable with debate. Business discussion can begin more quickly.

Power distance matters. In some cultures, participants defer to perceived authority figures, older participants, or those who speak first. This may mean focus groups are dominated by certain voices — or that one-on-one interviews would yield more honest individual responses.

Individualism vs. collectivism affects expression. In individualist cultures, participants freely express personal opinions that differ from the group. In collectivist cultures, group harmony may be prioritised, and participants may be more reluctant to openly disagree.

Adjust group composition based on culture — mixing genders, ages, or social classes may inhibit discussion in some markets

Adapt stimulus materials for local relevance where needed

Brief moderators on cultural context, not just discussion content

Interpret findings within cultural context — what looks like "agreement" may mean something different in different places

The luxury tequila study didn't stop at focus groups. To complement consumer discussions, we added two methodologies that revealed what people do, not just what they say.

Our fieldworkers conducted shop-alongs with five respondents in each market, observing how drinks are selected, ordered, and consumed in real social contexts inside luxury venues.

What we saw: Venue ambience influences spirit choice more than we expected. Peer dynamics shape ordering decisions — nobody wants to be the first to order something unfamiliar. And bartender recommendations carry enormous weight in unfamiliar categories. In luxury venues across APAC, the on-premise experience is where brand perceptions are formed — and where tequila had the greatest opportunity to make an impression.

Phase two involved in-depth online interviews with bartenders and mixologists from high-end venues across all five markets. Research shows that over half of consumers enjoy being educated about drinks by knowledgeable bartenders — these professionals are where brand strategy meets consumer experience.

The finding that changed the strategy: Many bartenders saw tequila as underrepresented on their menus — not because of consumer resistance, but because of limited training and brand support. They wanted better education about production methods, food pairing suggestions, and signature cocktail recipes for their specific clientele.

The outcome: The client walked away with more than data. They received clear strategies for positioning tequila as an aspirational choice, understood which occasions and venues offered the greatest potential, and knew how to engage bartenders as brand advocates. One research programme. Five markets. A complete roadmap for regional growth.

MindMarket coordinates multi-country qualitative research across 55+ countries — with local moderators, central quality control, and one point of contact for the entire project.

Fieldwork is where planning meets reality. Every decision you've made — objectives, sample, discussion guide, moderators — gets tested when real participants sit down in the room.

Confirm everything twice. Call participants the day before and send a reminder the morning of. In some markets (Southern Europe, Latin America, Southeast Asia), a personal phone call dramatically reduces no-shows. In others (Germany, Japan), the original confirmation is usually enough.

Test technology like it's going to fail. Because eventually, it will. Recording equipment, video feeds to viewing rooms, simultaneous translation headsets — check each one. Have backups. The session where the recording fails is always the one with the breakthrough insight.

Prepare stimulus materials in the exact order you'll use them. Sounds obvious. Isn't always done. Fumbling with concept boards mid-session breaks participant flow and makes you look unprepared.

The first 10 minutes determine everything. Participants decide quickly whether this is a space where honest opinions are welcome or where they should say what seems expected. Good moderators create psychological safety through warmth, genuine curiosity, and visible neutrality.

Watch for the quiet ones. In every group, someone hangs back. Sometimes they're shy. Sometimes they disagree with the emerging consensus but don't want to disrupt. The best insights often come from drawing out these voices: "Aiko, you looked like you might see it differently — what's your take?"

Manage dominators without silencing them. The participant who talks too much often has valuable contributions — they're just crowding out others. Redirect with acknowledgment: "That's a really helpful perspective, David. Let's hear if others have had similar or different experiences."

Probe the interesting moments, not just the scheduled questions. When someone says something surprising — an unexpected reaction, a contradiction, an emotional response — that's where insight lives. Follow it. The discussion guide is a framework, not a script.

Debrief immediately. Not tomorrow. Not after the next group. Within 30 minutes of participants leaving, while the moderator's impressions are fresh and specific.

Questions to cover:

What surprised you?

What felt culturally specific vs. potentially universal?

Which participants seemed most/least representative?

Any recruitment concerns? (Did they actually match the screener?)

What should we adjust for the next group?

Document the "feel," not just the facts. Written notes capture what people said. Debriefs capture how they said it — the energy in the room when the new concept appeared, the hesitation before answering the pricing question, the moment everyone leaned forward or checked out.

They will. Here's how to handle it:

| Problem | Response |

|---|---|

| Key participant no-shows | Proceed if 6+ remain. Below that, consider rescheduling. Never run with 4 or fewer — dynamics collapse. |

| Dominant participant derailing | Private word during break: "Your contributions are valuable — I want to make sure we hear from everyone." |

| Participant clearly doesn't match screener | Complete the session, exclude from analysis, flag with recruitment partner immediately. |

| Recording fails mid-session | Moderator takes detailed notes. Observer documents key quotes verbatim. Debrief is twice as important. |

| Participants know each other | Note it, watch for groupthink, probe individual views more deliberately. |

| Translation issues (with interpreter) | Slow down. Ask interpreter to capture meaning, not just words. Check understanding of key concepts. |

Stay invisible. In-person viewing rooms with one-way mirrors work best. For online sessions, cameras off, mics muted. Participants behave differently when they feel watched.

Send questions sparingly. One or two via text to the moderator during the session, maximum. Most questions should wait for the debrief. Constant interruptions break moderator flow and signal to participants that someone else is running the show.

Take notes on what you feel, not just what you hear. Your gut reactions matter. "Something felt off when they discussed the premium tier" is useful input for analysis even if you can't articulate why yet.

Analysis is where multi-country focus groups either deliver strategic value or collapse into disconnected observations.

Understand each market on its own terms before comparing. What themes emerged? What surprised you? What feels culturally specific versus potentially universal?

🌍 Global insights: Themes consistent across all markets. These suggest opportunities or challenges that transcend cultural boundaries.

🗺️ Regional insights: Themes consistent within cultural clusters. European markets may share patterns that differ from Asian markets.

📍 Market-specific insights: Findings unique to one country. These aren't failures of consistency — they're signals that local adaptation is needed.

"Chinese consumers prefer educational messaging while Australians prefer lifestyle positioning" is description.

"Chinese consumers prefer educational messaging because bartender credibility is essential for unfamiliar categories, while Australians prefer lifestyle positioning because cocktail culture provides an existing frame of reference" is insight.

The explanation makes findings actionable. Without it, you're presenting data. With it, you're providing strategic guidance.

Budget varies significantly based on scope, but here's a realistic framework:

| Component | Typical Range (per market) |

|---|---|

| Recruitment (8 participants × 3 groups) | $3,000–$6,000 |

| Facility hire (3 sessions) | $1,500–$4,000 |

| Local moderator | $1,500–$3,000 |

| Participant incentives | $1,200–$3,000 |

| Translation & transcription | $1,000–$2,500 |

| Total per market | $8,200–$18,500 |

For a 4-market study: Expect $35,000–$80,000 depending on complexity, location, and audience difficulty.

Factors that increase cost: Hard-to-reach audiences (medical specialists, C-suite executives, luxury consumers), simultaneous translation, premium facility locations, tight timelines.

Factors that reduce cost: Online focus groups, combining with other methodologies (like shop-alongs or online diaries), flexible timelines, established panel relationships.

The real question isn't "what does it cost?" but "what's the cost of getting it wrong?" — launching a positioning that doesn't resonate, or missing cultural nuances that tank your market entry.

Standard: 8 participants. Mini-groups: 4–6 (more depth or sensitive topics). Extended: 10 (broader input, less depth per person).

Smaller groups give each participant more airtime. Larger groups generate more diverse perspectives but less individual depth.

Standard: 90–120 minutes. Anything over two hours requires exceptional facilitation to maintain energy. Some topics can be covered well in 60–90 minutes.

That's valuable, not problematic. When markets disagree, verify it's real (not a methodology difference), understand why (cultural or market context), and recommend market-specific approaches where appropriate. Contradiction is often where the most actionable insight lives.

Online: Lower cost, no travel, geographic flexibility. Works well for many topics. 34% of researchers now conduct online qualitative regularly (ESOMAR, 2024).

In-person: Better for products requiring physical interaction, reading group dynamics, cultures where face-to-face matters. Worth the investment for high-stakes research.

Many studies now use hybrid approaches — in-person in priority markets, online in secondary markets.

Schedule around observer availability if live viewing matters. European groups are viewable from US East Coast in morning. Asian groups are viewable from Europe in early morning. Alternatively, use recorded sessions with next-day debrief calls.

Assuming what works in their home market will translate directly. The most expensive focus group studies are ones where findings can't be compared because methodology wasn't adapted for cultural context — or where real differences were dismissed as "outliers."

Three things: comprehensive briefing (all moderators together, understanding intent not just questions), a well-designed discussion guide that specifies objectives for each section, and daily debriefs during fieldwork to calibrate approach across markets.

Often, yes. Focus groups tell you what people say. Shop-alongs and ethnography show you what they do. Expert interviews tell you how the industry actually works. The luxury tequila study combined all three — and the shop-alongs revealed behavioural patterns that consumers themselves couldn't articulate.

Multi-country focus groups are genuinely hard to do well. The logistics are complex, the cultural dynamics are subtle, and there's plenty of opportunity for expensive mistakes.

But when it works — when you're watching consumers in Shanghai, Seoul, and Sydney react to your concept and suddenly understanding why it resonates here but not there — nothing else delivers that insight. Surveys can't show you people's faces when they see your packaging. Data dashboards can't capture the moment a bartender explains exactly why your brand isn't on their menu.

The global market research industry is now worth $140 billion annually (ESOMAR, 2024). That investment exists because the brands that understand people deeply, across cultures, make better decisions.

The complexity is what makes it worthwhile. 🌍

By Sina Salah

Founder & CEO of MindMarket International

MindMarket coordinates multi-country focus groups across 55+ countries — with local moderators, central quality control, and one point of contact for the entire project.

Everything. Everywhere. All in One Place.